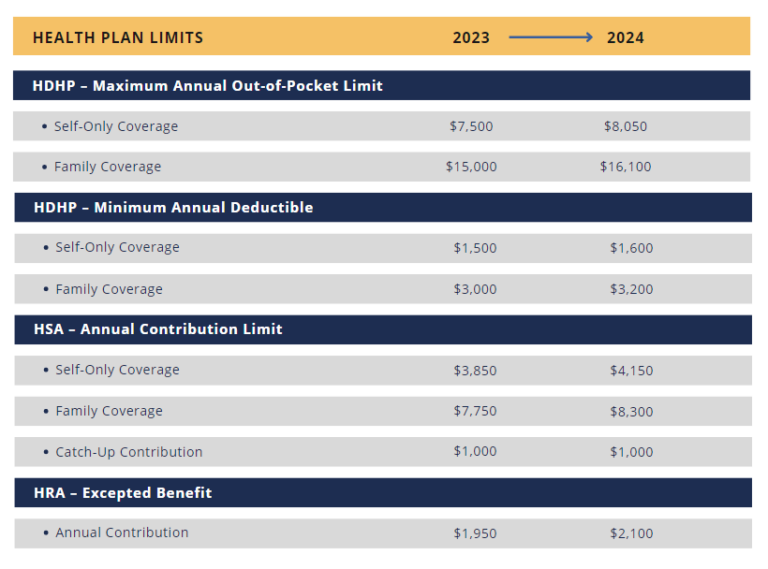

Irs Announces 2025 Hsa Limits. Employees will be permitted to contribute up to $4,150 to an individual health savings account for 2025, the irs said tuesday. The hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families.

Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16: For individuals covered by an hdhp in 2025, the maximum contribution limit will be $4,150.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, The limit for families will be $8,300.

IRS Announces 2025 Limits for HSAs and HDHPs, For calendar year 2025, the annual limitation on deductions for an individual with family coverage under a high deductible health plan is $8,300.

Hsa Limits 2025 Rycca Clemence, Those with family coverage under an hdhp will be permitted to contribute up to $8,300 to their hsas in 2025, an increase from 2025’s $7,750 maximum.

2025 Hsa Limits Explained By Employer Drusy Giselle, Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

Irs Announces 2025 Hsa Limits Cecil Adelaide, On may 15th, 2025, the internal revenue service (irs) announced the new hsa limits for 2025.

HR Insight IRS Announces HSA Limits for 2025 PeepTek Solutions, Those with family coverage under an hdhp will be permitted to contribute up to $8,300 to their hsas in 2025, an increase from 2025’s $7,750 maximum.

Hsa Family Limit 2025 Irs Hetti Tarrah, Those with family coverage under an hdhp will be permitted to contribute up to $8,300 to their hsas in 2025, an increase from 2025’s $7,750 maximum.

Irs Annual Hsa Contribution Limit 2025 Jess Carmelle, Hsa contribution limits for 2025 will see one of the biggest jumps in recent years, the irs announced.