2025 Ira Contribution Limits Over 55. Plus, find out whether you'll be able to deduct these from your taxes this year. In 2025, the 401 (k) contribution limit for participants is increasing to $23,500, up from $23,000 in 2025.

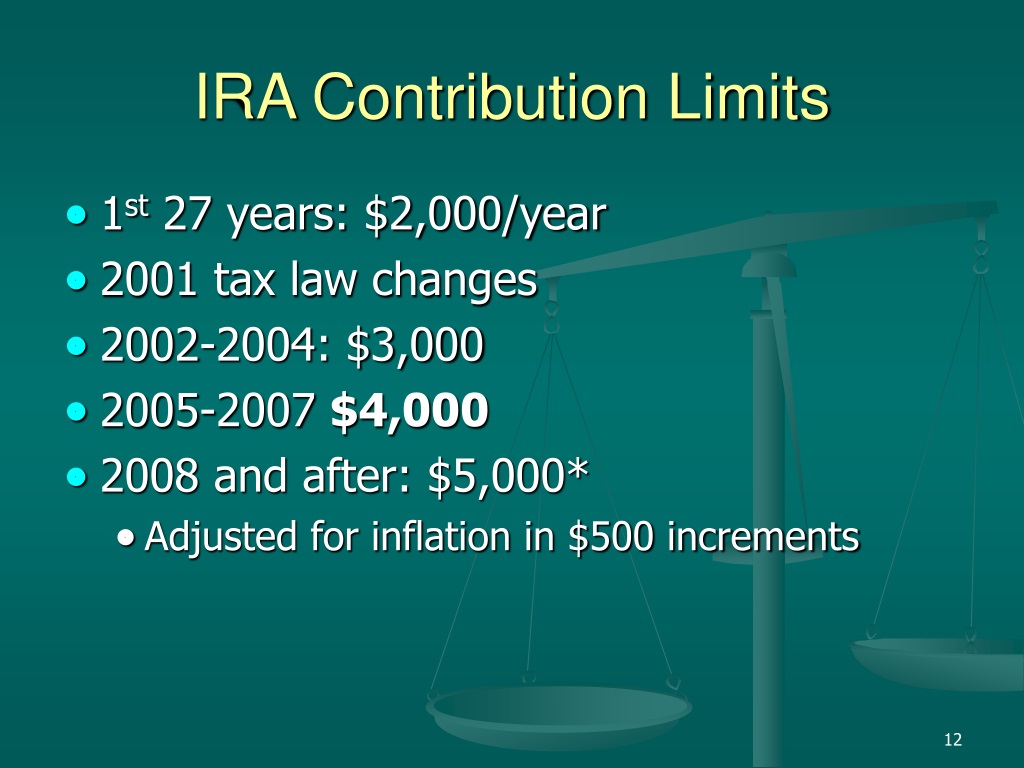

The contribution limits for a traditional or roth ira increased last year but remain steady for 2025. Ira contribution limits for 2025.

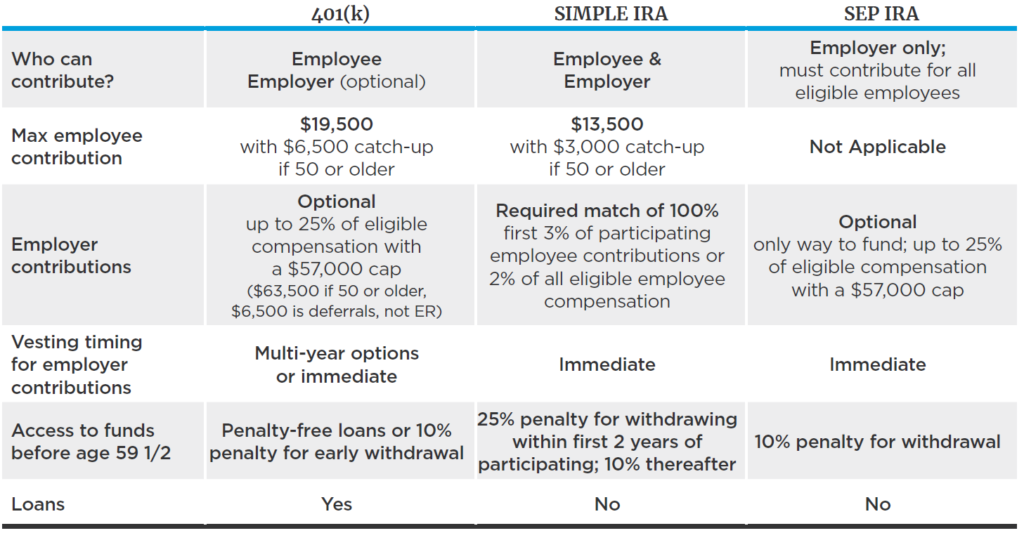

Simple Ira Employee Contribution Limits 2025 Alison Jackson, For 2025, 401(k) contribution limits are increasing by $500, from $23,000 annually to $23,500.

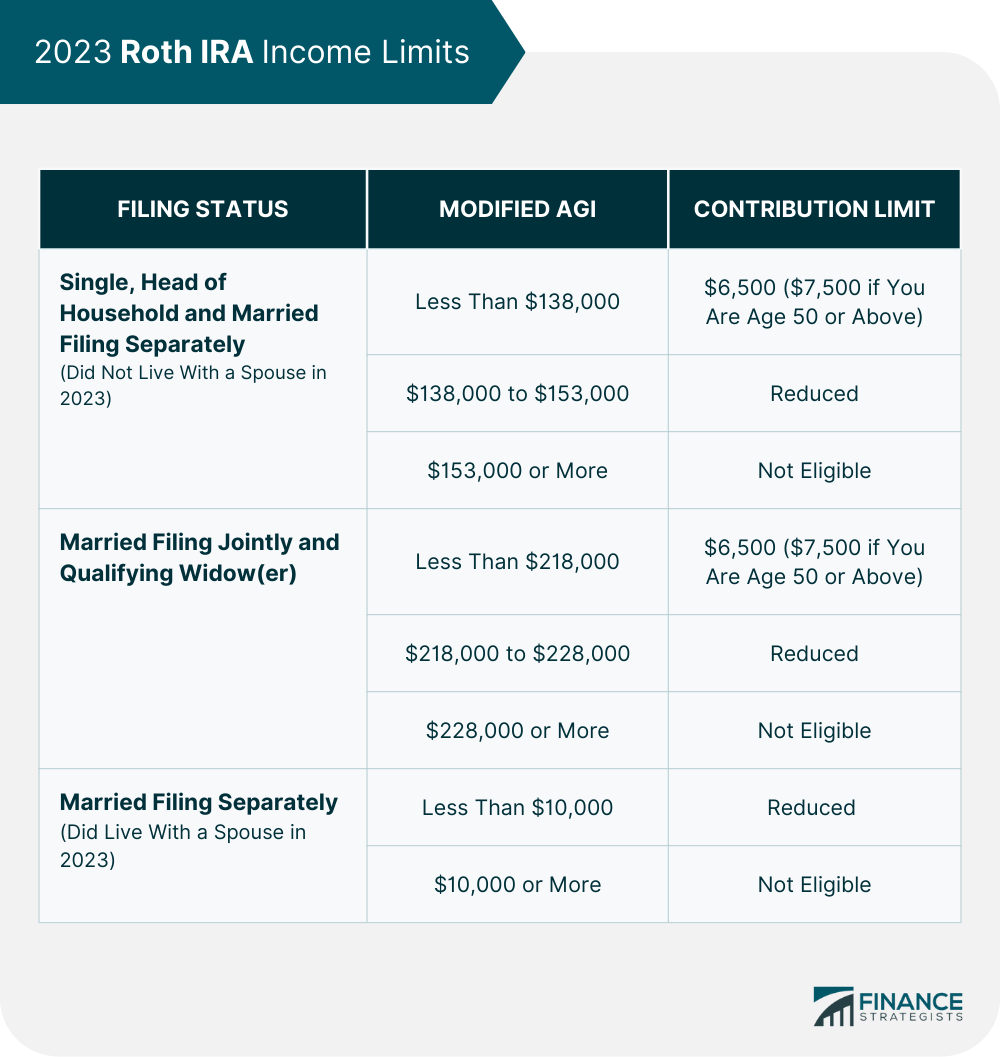

Limits For Roth Ira Contributions 2025 Carley Sandra, Learn how to maximize your savings and prepare for the future.

Ira Contribution Limits 2025 Over 50 Max Kelly, In 2025, the 401 (k) contribution limit for participants is increasing to $23,500, up from $23,000 in 2025.

Roth Ira Max Contribution 2025 Limits Over 50 Warren Metcalfe, And if you're 50 or older,.

2025 Ira Contribution Limits 2025 Limits On Sybil Ophelie, Learn how to maximize your savings and prepare for the future.

Roth Ira Contribution Limits 2025 Capital Gains Elizabeth Young, Take the time to understand the new limits and factor them into your financial plan.

Roth Ira Contribution Limits 2025 Phase Out Fiona Pullman, Traditional and roth iras remain at.

Ira Limit 2025 Over 60 Jack Lewis, Plus, find out whether you'll be able to deduct these from your taxes this year.